Nse:Vbl Financials

The NSE remains regulated by the Securities and Exchange Board of India (SEBI), which oversees the securities markets in India. SEBI has implemented several regulations and guidelines to ensure the NSE operates pretty, transparently, and efficiently. The exchange is also a member of the World Federation of Exchanges and is subject to international standards of regulation and transparency.

Table of Contents

Nse: Vbl Financials

VBL Financial Group Limited (NSE:VBL) is an Indian non-banking finance company (NBFC) providing various financial services. The company offers various types of loans, including home loans, loans against property, and personal loans, as well as insurance and wealth management services.

As of my knowledge cutoff in September 2021, VBL Financial Group Limited had a market capitalization of approximately INR 10.7 billion and had reported a total income of INR 1.04 billion for the fiscal year ending March 31, 2021. However, please note that these figures may have changed since then. It remain

recommended to refer to the latest available financial reports and updates from the company or trusted financial sources for up-to-date information.

The NSE has also been key in developing India’s debt markets. It was the first exchange in India to introduce an electronic platform for trading in government securities. It has since expanded its offerings to include trading in corporate bonds and other debt instruments.

The exchange has several initiatives to promote investor education and awareness. It has launched a number of programs and campaigns to educate investors about the risks and benefits of investing in the stock market and to encourage more retail investors to participate in the market.

Overall, the NSE has played a crucial role in developing India’s financial markets, providing a transparent, efficient, and reliable platform for investors to trade in equities, derivatives, and other financial instruments. Its advanced trading technology, strong regulatory oversight, and commitment to investor education have made it one of the leading stock exchanges in the world.

What is Varun Beverage Limited?

Varun Beverages Limited is a leading Indian soft drink manufacturer and bottler for PepsiCo. The company was founded in 1995 and remains headquartered in New Delhi, India. Varun Beverages is in more than 25 countries across Asia, Africa, and Europe and is the largest franchisee of PepsiCo in South Asia. The company’s product portfolio includes carbonated soft drinks, non-carbonated beverages, packaged drinking water, and juices. Varun Beverages operates over 30 bottling plants and has a strong distribution network covering over one million retail outlets.

What is Varun Beverage Limited popular for?

Varun Beverages Limited is popular for being the largest franchisee of PepsiCo in South Asia. The company is known for manufacturing, selling, and distributing a wide range of PepsiCo’s soft drink brands, including Pepsi, Mirinda, Mountain Dew, 7UP, and Aquafina. Varun Beverages is also known for its strong distribution network, enabling it to reach millions of consumers across India and other countries. The company has been expanding rapidly in recent years. It has become a significant player in the Indian soft drinks market thanks to its strategic partnerships with PepsiCo and its focus on innovation and sustainability.

What are the factors that affect Varun Beverage Limited Stocks?

As with any publicly traded company, the stock price of Varun Beverages Limited can remain influenced by a variety of factors, some of which include:

Financial performance: Varun Beverages’ financial performance, including its revenue, profitability, and earnings growth, can have a significant impact on its stock price. Positive financial results often increase the company’s share price, while negative results can lead to a decrease.

Industry trends: Varun Beverages operates in the highly competitive soft drinks industry, subject to changing consumer preferences and trends. The company’s stock price may affected by broader industry trends, such as shifts in consumer preferences towards healthier beverages or changes in demand for specific products.

Economic conditions: Inflation, interest rates, and overall market conditions can impact Varun Beverages’ stock price. A strong economy and favorable market conditions may increase the company’s share price, while economic downturns and market volatility may lead to a decrease.

Company news and announcements: Varun Beverages’ stock price can remain influenced by information and announcements related to the company, such as new product launches, partnerships or collaborations, changes in management, and financial guidance.

Global events: Global events, such as natural disasters, geopolitical tensions, and pandemics, can impact the global market and affect Varun Beverages’ stock price, mainly if the company operates in regions that are directly affected.

What is the annual income of Varun Beverage Limited?

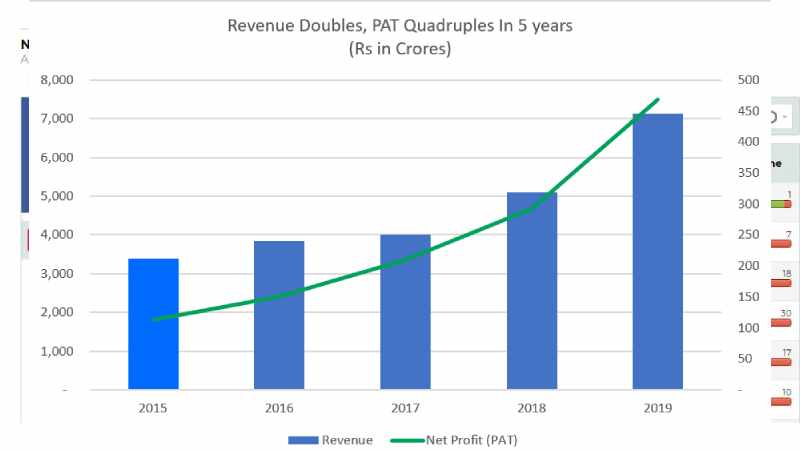

The annual income of Varun Beverages Limited can vary from year to year based on various factors such as revenue growth, profitability, and operational expenses. However, according to the company’s financial reports, for the fiscal year 2020-21 (April 2020 to March 2021), the company reported a consolidated revenue of INR 14,990 crore (approximately USD 2.04 billion) and a net profit of INR 628 crore (approximately USD 85 million). It’s worth noting that the COVID-19 pandemic impacted the company’s financial performance in the fiscal year 2020-21. The company’s revenue decreased by 6% compared to the previous year, while its net profit declined by 16%.

Is it reasonable to be a shareholder of Varun Beverage Limited?

Whether investing in Varun Beverages Limited is reasonable depends on many factors, including an individual’s financial situation, investment goals, and risk tolerance. It is important to thoroughly research the company’s financial performance, management team, competition, and growth prospects before making an investment decision. Additionally, investors should consider the potential risks associated with investing in the company, such as changes in consumer preferences, regulatory changes, and economic conditions. It remains recommended to consult with a professional financial advisor before making any investment decisions.

Advantages of investing in Varun Beverage Limited

Some potential advantages of investing in Varun Beverages Limited may include the following:

Strong market position: Varun Beverages is the largest franchisee of PepsiCo in South Asia and has a strong market position in the Indian soft drinks industry. The company has a vast distribution network and a diverse product portfolio, which helps it to reach millions of consumers across India and other countries where it operates.

Experienced management team: Varun Beverages has a highly experienced management team with a track record of driving growth and profitability. The company’s management has successfully expanded its operations through acquisitions and partnerships and remains committed to innovation and sustainability.

Conclusion of Varun Beverage Limited

In conclusion, Nse:Vbl Financials is a leading Indian soft drink manufacturer and bottler for PepsiCo, with a strong market position in the Indian soft drinks industry. The company has a diverse product portfolio and a wide distribution network, enabling it to reach millions of consumers across India and other countries. Varun Beverages has a highly experienced management team with a track record of driving growth and profitability and a commitment to innovation and sustainability. While investing in Varun Beverages has potential advantages, it is important to conduct thorough research and consider the risks associated with investing in the company before making an investment decision.

FAQs for NSE: Varun Beverage Limited Financials

Sure, here a some frequently asked questions (FAQs) related to Varun Beverages Limited’s financials on the National Stock Exchange (NSE):

When does Varun Beverages Limited report its financial results?

Ans: Varun Beverages Limited typically reports its financial results every quarter, and the company follows a fiscal year that begins on April 1 and ends on March 31.

Where can I find Varun Beverages Limited’s financial statements on NSE?

Ans: Its financial statements, including its annual reports, quarterly results, and other financial disclosures, can remain

found on the NSE website under the “Corporate Filings” section.

What is Varun Beverages Limited’s revenue for the latest fiscal year reported?

A: Varun Beverages Limited’s for the fiscal year 2020-21 (April 2020 to March 2021), Varun Beverages Limited’s consolidated revenue was INR 14,990 crore (approximately USD 2.04 billion).

What is Varun Beverages Limited’s net profit for the latest fiscal year reported?

Ans:The fiscal year 2020-21, Varun Beverages Limited’s net profit was INR 628 crore (approximately USD 85 million).

Does Varun Beverages Limited pay dividends to its shareholders?

Ans: Yes, Varun Beverages Limited pays dividends to its shareholders regularly. The company has a dividend policy of distributing at least 30% of its profit after tax to shareholders. The dividend payment is subject to the approval of the company’s board of directors and shareholders.

Related searches

varun beverages share price

vbl share price

beverages

varun beverages share

varun beverages

vbl share price nse

varun

nse: vbl

bevco login

creambell

varun beverage share price

varun beverages share price nse

vbl share

voting percentage today

vbl

varun beverages share price bse

creambell

varun beverages products

varun beverages ltd

share price of varun beverages

pepsi share price

varun beverage share

pepsico share price

rj corp

2Nse:Vbl Financials

sting energy drink price

Nse:Vbl Financials

varun breweries share price

vbl share price today

varunbeverages share price

share price of vbl

nse:vbl financials

nse vbl

Nse:Vbl Financials